Larry Summers is a very smart guy, and we should listen to him now as the Biden Administration should have listened to him in 2021 when he warned about inflation. That having been said, I don’t think it’s correct to say that we are in a financial crisis yet. There have been some signs that we were headed toward one, but a choppy Treasuries market caused by hedge-fund selling to raise cash is not, in itself, something to panic about. The Long Term Capital Management crisis in 1998 did require some coordination among major players to resolve, but was nonetheless resolved pretty easily. (For America, that is. Not so much for Russia, which triggered the crisis with their default.) If all we’re talking about is highly-leveraged players panic-selling while the usual buyers stand ready to buy, we should be able to weather this.

As Adam Tooze explains very well in this piece, therefore, the people to watch aren’t the sellers but the buyers. The reason we have to worry about them is that many of those buyers are foreign central banks, and the United States government has just declared financial war on basically every foreign government. That’s the fundamental difference between the current situation and, say, 2008, when there was a lot of successful coordination between central banks, very much including China. Are they going to be similarly helpful this time, when helping America out means helping out President Trump—and, specifically, rewarding him for attacking them?

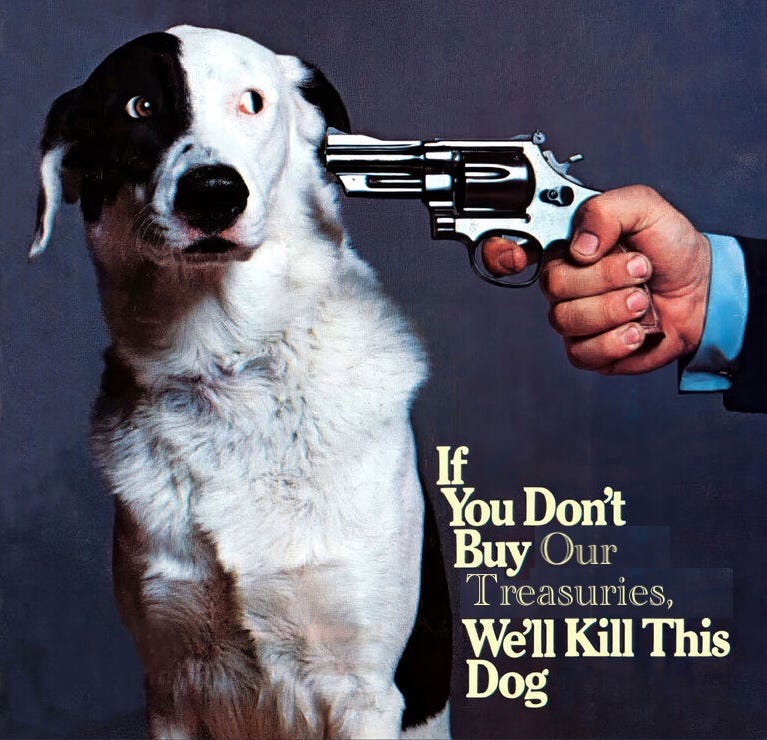

Maybe they will. Inasmuch as if they don’t step up we could have a full-blown financial crisis, which would cause them enormous economic damage, we’re basically playing out a version of the famous National Lampoon cover:

In my last post on the tariffs, I linked to Sam Hammond’s excellent tweet thread about what the radical thinkers behind Trump might be after. If he’s right, and there actually is a crazy plan (as opposed to mere economic illiteracy coupled to arrogant bullying), then a financial crisis is exactly what they want—they’re threatening to kill Cheeseface because they believe the rest of the world will do whatever we ask to stop us from pulling the trigger. But I don’t think it’s very likely that the script will go the way they plan, with the various world financial powers getting together to negotiate a new global financial architecture that’s even better for America than what we had before.

Instead, I think there are, in broad strokes, four possible roads forward:

Trump blinks. At any point, the president could decide to declare victory and go golfing. He could do this wholesale or he could announce deals on a country-by-country basis; he could do a grand deal with China or he could keep his tariffs on China and cut deals with other countries. Whatever he does, if it provides some evidence to the markets that there is an end-game, the risk of financial crisis would recede, and would continue to recede as more positive evidence accumulated. A high likelihood of some version of this path is implicitly priced into the markets right now. Blinking doesn’t mean we’d necessarily avoid a recession, or that America would be better off after all this drama. I think the likelihood is that we’ll have damaged our reputation as a trading partner and steward of the world financial system for very little or no gain. But if Trump blinks, we’ll avoid the abyss.

The GOP cracks. This whole war could also end tomorrow if Congress took back its constitutional responsibility for setting tariffs. There are already moves in this direction, at least in the Senate. Since Trump is overwhelmingly likely to veto any such move, they’d need a two-thirds majority in both houses, which is a tall order. That means either the entire congressional GOP would have to turn against their own president, or the party would have to split in two. Either would likely destroy the GOP for a generation. Precisely because that’s such an extreme negative political outcome from a GOP perspective, I don’t think we’d get there unless and until the economy goes into a full-on tailspin. But if we do go into a full-on tailspin, the craven calculations that currently govern much of the party might well change.

China steps up. I don’t know that China is prepared, institutionally, to step up. But they do have the resources, and a full-blown crisis would present them with the opportunity, in conjunction with the European Union, to inaugurate a new financial architecture, a new basis for global finance other than U.S. Treasuries. This scenario could, in the short term, feel relatively good; it could start with foreign coordination to calm the bond market so as to avert an acute crisis. But they’d be coordinating not to help us but to get the dog away from the guy with the gun. With every auction they’d demand steadily higher interest rates, squeezing America harder and harder fiscally, and in the background there would be net selling of Treasuries by the whole world in favor of whatever they come up with instead as the basis of global finance. This would have far worse long-term repercussions for the United States than Trump blinking, but the transition might be smoother than you might imagine, and it would leave open the opportunity to rebuild in a China-led world.

The Fed monetizes. If Trump doesn't blink, Congress doesn’t crack, China doesn’t step up, and the Treasuries market does go into crisis, then the Fed will have to be the buyer of last resort. The Fed was extraordinarily successful at stabilizing the economy in 2020 by engaging in massive purchases, and they could do that again—there’s really no limit to how much liquidity they can pour into the system. But here’s the thing. If the shock were exogenous, then the markets would be pleased to see the Fed stepping up to provide stability, and while there might well be a hangover in terms of inflation, the markets would anticipate that the Fed would handle that appropriately as well; we’d basically see a replay of the post-Covid period, with maybe more of a contraction so as to prevent quite so much inflation. This isn’t an exogenous shock, though. If the Fed steps up to buy Treasuries during a crisis created by the administration launching a financial war of choice, then the market may well see that as a sign that the Fed is monetizing America’s debt. At a minimum they’d have to price in the risk that Trump sees it that way. Monetizing your debt is how you get hyperinflation. Even if we don’t spiral all the way, at a minimum the Fed’s credibility would be destroyed. And in the worst case, we’re Russia or Argentina after their defaults, only much, much bigger.

That’s how I see things. I’m curious to hear other informed views.

Looks like Option 1!

So I’m confused about something. China dumping treasuries is supposed to be a bad thing, but if we run a giant trade deficit then China is just going to accumulate more and more treasuries to dump at some future date. What is the off ramp supposed to be?

The EU already called China and told them they “better not dump a bunch of cheap goods into the EU” since they are no longer going to trade with America. This is a strange response if trade deficits are great.

In reality the EU has been steadily increasing tariffs on Chinese goods as its trade deficit with them has grown. Its trade surplus with the us has been a way to partially offset this growing deficit with China. If the EU stops trade with America and turbocharged it with China an explosion of its trade deficit and hallowing out of its industries is an inevitability. Which is why they’ve been walking down the same path as Trump at a slower pace.

They could cut a deal where both of them cut China off and China decides to re-orient towards more domestic consumption.

Oh and also the EU is going to stand up to Putin by…buying the goods of the country supplying Putin.